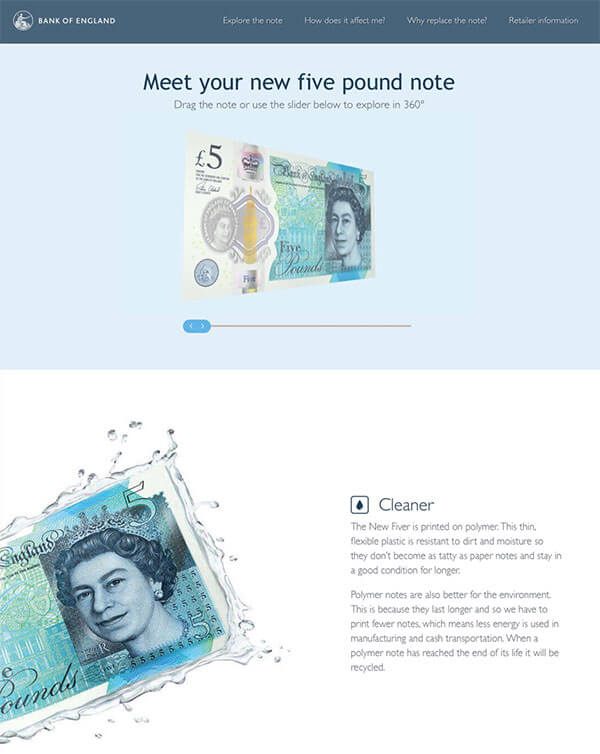

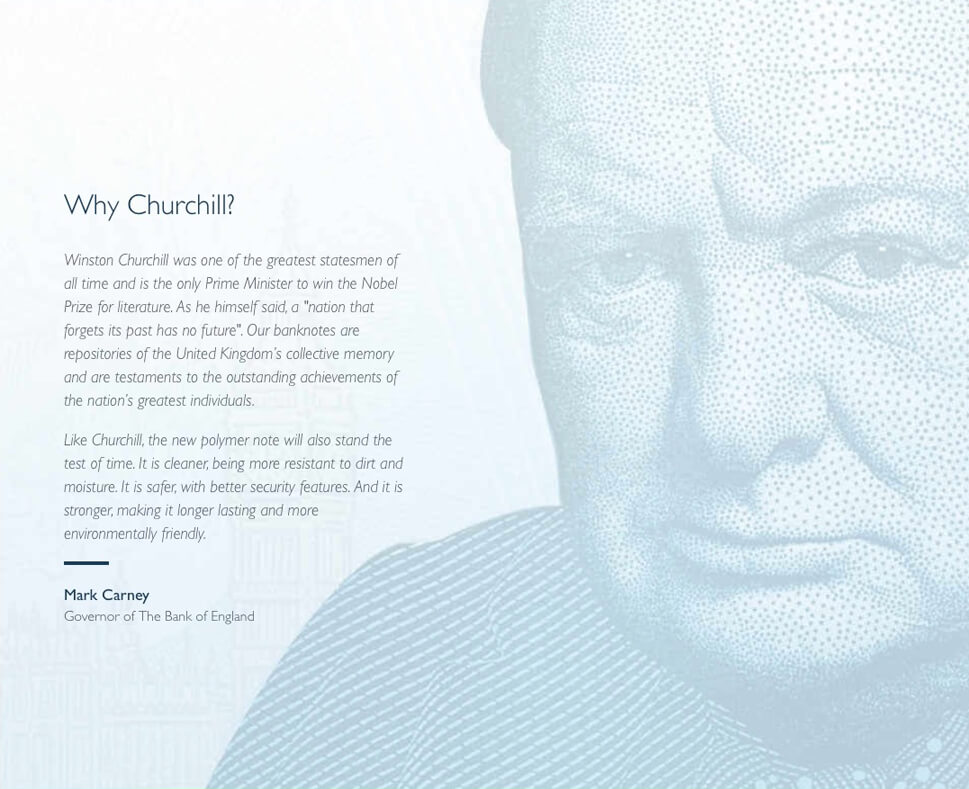

The Bank of England was ready to unveil Britain’s first polymer banknote, which featured none other than Sir Winston Churchill. But, the Bank needed to raise trust and educate the public about the new design before release. As part of their nationwide integrated marketing campaign, Cyber-Duck was selected to produce a stunning new website that offered unique ways to interact with, explore and share The New Fiver. The website received over 650,000 visitors in the first four months after launch.

Awards won

- Awwwards - Voted Honourable Mention for the Bank of England New Fiver website design

- Wirehive 100 Awards - Runner-up for Consumer Website of the Year for the Bank of England's New Fiver website

Share your vision. Let's work together

Whatever the project or particular challenge you have in mind, we’re here with the right people, process and technology to help deliver the transformation you need.