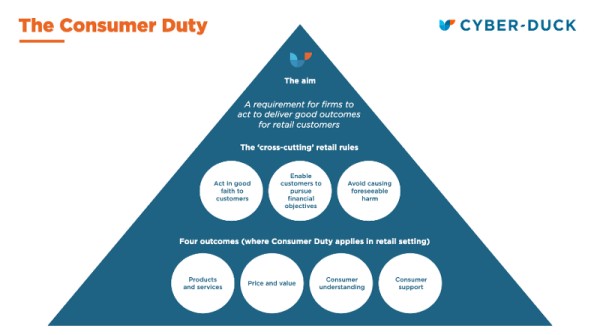

The FCA, regulator for c.50,000 financial services and markets in the UK, published a finalised Consumer Duty paper in July 2022 bringing new guidelines to improve customer and user experience in UK financial services.

With the aim to help people achieve their financial objectives, the Consumer Duty includes “a new Consumer Principle that requires financial firms to act to deliver good outcomes for retail customers”.

The FCA Consumer Duty 161 page PDF outlines key points on what financial institutions (such as banks and insurers) need to do to comply with regards to their products, services, pricing, and what type of support they need to offer to customers.

The Consumer Duty aims at a higher level.

A summary of the rule is described as follows by the FCA: “Our rules require firms to consider the needs, characteristics, and objectives of their customers — including those with characteristics of vulnerability — and how they behave, at every stage of the customer journey. As well as acting to deliver good customer outcomes, firms will need to understand and evidence whether those outcomes are being met.” So not just doing things well, but being able to clearly demonstrate how they are doing it.

A holistic, sustainable approach

We believe that accessible design is the best design to create the best user experiences. Technologies developed through the lens of the end user that were specifically developed for people with different types of disabilities have ended up benefiting people without them.

For example, during 1999, T9 Predictive texting which was originally developed for users with motor issues, sped up how we all send and receive SMS messages.

Equally, technologies that were not developed originally for disabled users have massively benefited people with impairments. Amazon Alexa, which launched in 2015, is a great example of this.

Innovation in the Web itself demonstrates that accessible websites, load faster, are easier to use, load on more devices and make it quicker for users to complete their tasks. If user journeys are faster and easier, it not only benefits the user’s life quality but also the environment as it reduces energy usage, data transfer and makes consumers feel better about the service, the brand and themselves. A brilliant example of UN’s definition of sustainability, which talks about balancing economic growth, environmental care and social well-being for todays and future generations.

Beyond fair, to good — whatever that is…

The FCA are adamant that “consumers receive suitable products and services and receive good treatment” so that consumer confidence grows whilst ensuring diverse consumer needs are met. The new Consumer Duty rules, however, sets higher standards than ‘fair value’ and seeks actively ‘good outcomes’.

The definition of a good outcome is fuzzy and down to each financial institution and ultimately the FCA to figure out as Consumer Duty evolves.

The need for a service design approach

The Consumer Duty principles impact all UK retail financial institutions that serve the general public. The principles are quite broad and contain various commercial, financial, operational and legal implications for banks, which impact the interconnected and complex physical and digital products, services and processes they provide. This article will set out the Design approach and principles we can draw out of our analysis of the Consumer Duty paper.

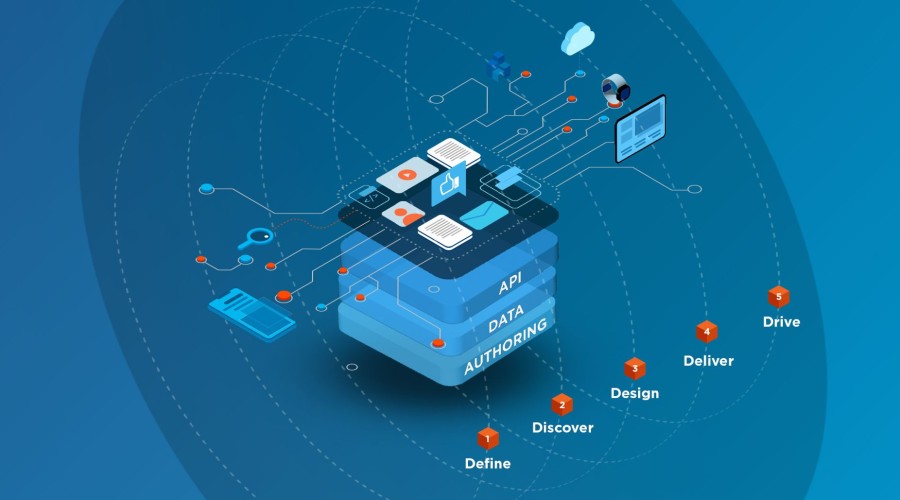

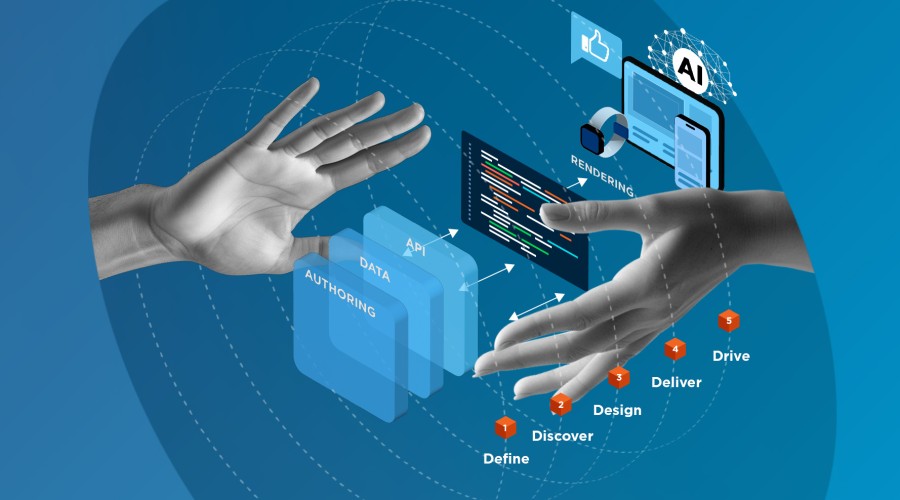

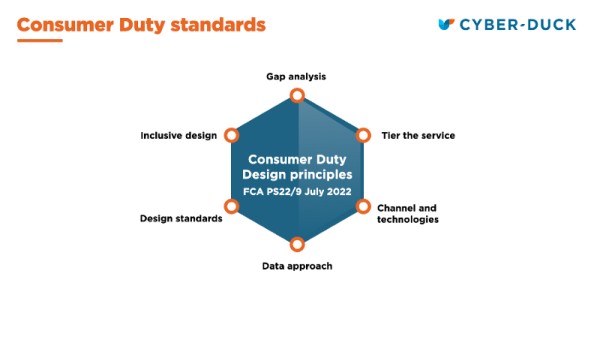

Our approach on how to meet the Consumer Duty user experience and customer experience principles through various steps including analysis, tiering, setting standards and an inclusive design approach.

Gap analysis

This is the usual starting point for most banks when it comes to Consumer Duty: assessing current performance to determine if the new requirements and objectives are already being met and, if not, what steps need to be taken to meet them. Here, the bank will need to conduct and/or scrutinise any work done so far on Consumer Duty work internally in accordance with the FCAs final rules.

Banks will need to evidence that they “put consumer needs first” and set “higher standards” which is the ‘cornerstone of the duty’.

According to the FCA, they want to see a “higher level of consumer protection in retail financial markets, where firms compete vigorously in consumers’ interests”. Due to this, banks will need to define their own inclusive design standard based on the final rules and what constitutes a user acceptance, failure or warrants an improvement using a defined and measurable scale.

It would be wise to banks to benchmark themselves with the market too. Banks will need to define their user persona types and include accessibility needs based on its unique products and services. The bank may find common challenges and gaps across its products and services with regards to usability that impact a ‘good outcome’ for various persona types particularly when it comes to vulnerable users.

The gap analysis should explore omnichannel, end-to-end persona journeys from researching a banks’ products and services, registration, KYC, transactions, messaging, support all the way to switching a product (where possible) and closing an account — both in physical and digital environments. The gap analysis should highlight acceptance and failure gaps compared to the final rules and desired standards.

Tiering of services

As part of the gap analysis, organisations will need to audit their existing products, services and variations of them and prioritise which ones contain criteria that fail to comply with the final rules and best practice.

Consumer Duty ultimately means that a bank should create a “healthier financial service system where consumers are informed” and it ‘adapts and delivers’ in interests of consumers.

So how does a bank do this, particularly with regards to personas that are classified as vulnerable? Banks can use inclusion, utility or task scales to rate how well their products and service conform to the rules criteria.

However, not all products and services are created equally. Where a bank has a higher amount of users, more vulnerable users and where the product and service is new/newer as opposed to a discontinued one, it could be that it will need to create a priority system using tiers.

This is because newer products will be under more Consumer Duty scrutiny than legacy and closed-book products. Older products and/or those where there are less ‘vulnerable’ customers may be able to have a ‘lighter touch’ redesign approach.

Channel and technology standards

Customers leverage a myriad of channels to engage with banks products and services. Most banks will take an omni-channel approach when thinking about good outcomes. Forward thinking banks will need to consider where vulnerable user requirements come into play when engaging across different channels.

What the FCA wants to see is ‘good outcomes’ across channels.

The more channels a bank offers for utility and support the more choices vulnerable personas will have, and this is positive– but each channel needs investment in terms of systems, processes, technology to ensure that holistic experience is seamless and consistent.

The goal is for the channel to ‘remember’ the user, their statuses and preferences and enable channel relevant utility whilst considering, accessibility security, privacy, and technology constraints. When considering omnichannel experiences, blueprinting should explore how the user journeys across channels relate to channel back-office teams to ensure all channels operate optimally with the right resource and processes.

A successful omnichannel experience requires robust underpinning systems and technology (such as a decoupled front-end HTML, CRM, AI/ML) that can evolve with the pace of innovation According to Consumer Duty: “An outcome approach applied to technological change means consumers are better protected from new and emerging harm.”

Data approach

With Consumer Duty, banks will need to redefine the meaning of data. In the FCAs words: “Under the Duty, firms will need to assess and evidence the extent to which and how they are acting to deliver good outcomes. Combined with our more data led approach, this should enable us to more quickly identify practices that negatively affect those outcomes and to intervene before practices become widespread.”

In the context of Consumer Duty, data is not only evidence of compliance but a way to prove acceptance criteria through validating conformity and acceptance. This is where bytes and bits, research, the funnel, KPIs, records and even complaints and errors converge against functionality and content.

As ‘data is everything’ and in many instances, most all the customer experience can be measured digitally, the FCA and/or other auditors/regulators might be able to scrutinise the entire customer experience at scale. Banks will need to be able to document monitoring of customer satisfaction (including vulnerable users) and show how errors or issues are quickly identified and improved upon to evidence compliance and continual improvement.

As and where the ‘data is about testing’, it is important to not just show the results of tests but extend these to insights and understanding so that good outcomes can be generated. The Consumer Duty mandates that: “…We want firms to be able to demonstrate consumer understanding — because they have tested it and made improvements to their communications, where appropriate, to support good outcomes.”

Design standards

Based on the pillars of inclusive design and the data approach, it is key to define the functionality and content design standards across channels to ensure that products, services, and features are designed in the most accessible way possible.

A good place for inspiration is the GDS service manual that highlights how .gov.uk design standards need to be rolled out on products and services, although each bank and organisation is free to create their own design manual or design system or design standards (or a combination of these).

One of the key goals from the FCA with Consumer Duty is to “Simplify the complex”. The FCA recognised that as inflation and the recession is looming, that users: “we’re being asked to make an increasing number of complex and important decisions in a faster and increasingly complex environment.”

This is where design standards can help. Design standards will examine the channel and technology standards as well as the data approach to ensure that user-centricity fuels innovation and vice-versa.

For example, where voice modalities are used, how much automation and customisation needs to be in the interface and where would a human voice or assistant be required?

Talking about voice, how can a user escalate issues to a human and how quickly? The Consumer Duty talks not just of design standards but ‘how quickly complaints are dealt with’.

Ultimately, insurers and banks should demonstrate that complaints were documented, scrutinised, dealt with promptly and fed into continual improvement to improve the experience for ‘other’ users.

Cyber-Duck's design guidelines for The Bank of England.

Inclusive design

The FCA really wants to see how information empowers consumers of banks by ‘simplifying the complex’ as much as possible. It also wants to see a complete end to “selling misleading products”, “lack of fair value” to customers and see “an end to poor customer support” — hopefully most organisations will conduct gap analysis as described above to nip anything like this in the bud — it is 2022, and no respectable financial services institution should knowingly mislead any customer after the various mis-selling scandals!

While it might be hard for the more ethical designers out there to understand why banks ‘mislead’ or offer ‘poor support’, the future thinking Consumer Duty is about setting high standards to good outcomes. According to the Duty: ”we want consumers to be given the information they need, at the right time, and presented in a way they can understand”.

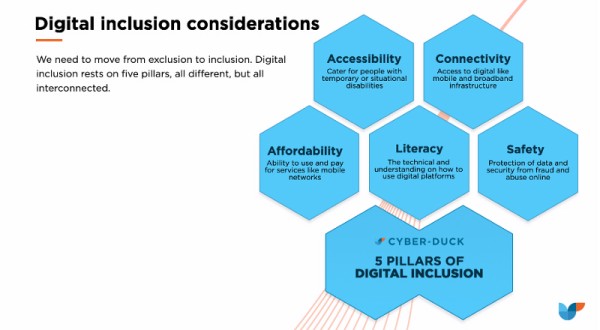

Our 5 pillars of digital inclusion model can yield paradigms that incorporate facets of accessibility, connectivity, affordability, literacy and safety to enhance the financial institutions’ existing personas and attitude towards research. None of these facets exist in isolation of each other (see the diagram in the conclusion section).

The idea is not to replace existing personas but ‘enhance’ and expand both user research and the ‘personification’ of user journeys with the five pillars and introduce attributes like situational or permanent impairments, life changing situations (e.g., a bankruptcy, family death, wedding or a divorce), English not being a first language, lower degrees of literacy, a moderate understanding of how to use web forms and/or a reluctance to use mobile apps.

Inclusive design, however, is not compulsory according to the FCA. The FCA said this: “we are not requiring firms to follow an inclusive‐design approach but, in the Guidance, we suggest firms may wish to consider it.”

The FCA specify that: “We want all products and services for consumers to be fit for purpose. We want them to be designed to meet the needs, characteristics and objectives of a target group of customers and distributed appropriately. These are essential steps if firms are to act to deliver good outcomes to consumers.” Not only is the right thing to do, we would always recommend inclusive design thinking to be applied based on the ‘tier the services’ approach above and to ‘future-proof’ financial businesses against potential regulatory requirements.

Conclusion

Consumer Duty contains several essential components that are important from a Service Design perspective as Service and UX Designers have the opportunity of refactoring journeys to ensure they are compliant. Channel choice is one. The FCA says that: “Firms should also have processes in place to support those with other characteristics of vulnerability … for example, by having a clear way for consumers with a hearing or visual impairment to request communications in a format that meets their needs.”

The 5 pillars of Digital Inclusion.

Testing products and services on an ongoing basis to ensure they comply is also critical. A big part of products and services contain communication modules and functionality. This include ’app modals’, push notifications, geofencing features, phone calls, chatbot support and of course email communication. Testing all communication around key products and services with vulnerable users is particularly beneficial as it could reveal key gaps in user satisfaction and fulfilment and uncover numerous issues and errors not only with the communication itself but with overarching utility and functionality.

With regards to literacy, the FCA recognise the low literacy rate among adult males in the UK. A Financial Lives Survey found 17.7 million adults (34%) have poor or low levels of numeracy involving financial concepts.

So, they say that if a firm is developing a mass‐market product, firms are expected to make products and services understandable and work for audiences with low numeracy skills. However, if a firm is developing or communicating about a complex product with a more sophisticated target market (e.g. a professional investor audience) it may consider other paths. All of this should be part of a service design approach to achieve good outcomes on an ongoing basis.