We know that design is key to a company’s products and presences. UX designers ensure the user experience is pleasurable and seamless. Visual design reflects a brand’s visible “personality” – vital for audience engagement and customer loyalty. But today, design increasingly plays a strategic role too.

Earlier this year, we attended the virtual FinTech Design Summit to hear how industry leaders worldwide are applying design thinking to their strategy.

From empathy to developing trust and involving users in product development, we’re going to take a closer look at the steps companies like Plaid, Airwallex and CRED take to leverage the strategic power of design.

Perhaps the first – and often biggest – misconception about design is that it’s just about making things look good. But as Steve Jobs said, “Design is not just what it looks like and feels like. Design is how it works.” It’s a process that creates an experience – and it’s much more subtle and complex than many people realise.

That experience always has a purpose. It could be to create an emotional response in the user, or to simplify how a user uses your app or website. It could even be the language you use, and the quality of the information and answers you deliver, both of which contribute towards attracting and retaining users.

Purpose makes design strategic; process makes it scalable. And as you’ll see from the approaches below, the most successful companies are methodical in their purposes and processes.

Get your free white paper: 6 pillars for Digital Transformation in Financial Services

The UX mindset: Understanding your users

One of the first things you’ll notice about these companies is the humility of their design teams. That’s key for a UX mindset. They know they are not their users, and therefore go to great lengths to understand them. It’s only by understanding their users’ similarities and differences that designers can meet the needs of different types of users. And it’s only with that understanding that they can develop empathy and earn trust.

1. Plaid: Translate your user research into products

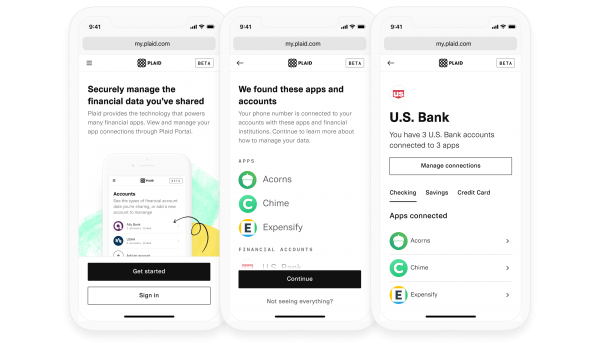

Plaid are developers for developers. They connect financial institutions to fintech apps like Venmo, Betterment and Wave, making it easier and safer for companies to build innovative financial services and applications.

When they started out, Plaid quickly realised that trust and convenience were key when customers were choosing – and staying with – a product. Consumers also wanted more control before, during, and after a transaction. They wanted to be able to customise their choices of banks, for example, or quickly and easily cancel a payment if they changed their mind. Essentially, users wanted their online experience to resemble an in-person experience as far as possible.

Founded in 2013 and already valued at more than $730 million, the company attributes its success not to its product, but in translating its user research into products. This means user-centred design, and Plaid breaks their process down into three steps:

-

Workshops – research and discovery sessions through which the product and UX designers uncover their end-users’ problems and desires.

-

Usability testing – so target users can use and comment on prototypes and their feedback can be incorporated as products are developed.

-

Transparency – sharing their knowledge with their developer audience, which helps create trust. Plaid does this through their blog, and also by actively involving their users in developing better UX.

2. Revolut: Create a core product that you can adapt for each market

Revolut is every entrepreneur’s dream. Founded in 2014, it now employs over 3,000 people in more than 20 countries, and, according to Alessio Fasciolo, the company’s product designer, the speed and solidity of Revolut’s growth is a testament to its core tenet of process.

Revolut specialises in mobile banking, card payments, money remittance and foreign exchange, with the mission of building a fair and frictionless platform to use and manage money around the world. It was clear to them early on, however, that this wouldn’t be easy, given the differences in financial regulations between countries.

There were also cultural differences in perceptions of credit, which had a direct impact on product/market fit and how they would present their platform to meet user expectations.

The solution, they realised, lay in centring themselves and then adapting to different countries’ regulations. The only way to do that was with a single, core product. Now they didn’t have to re-invent the wheel every time – they had core process and infrastructure in place.

Revolut’s success was almost immediate. They launched their second country in half the time it took for the first, proving that their design process was agile. From there, Revolut simply kept iterating on their process as they scaled.

The key elements to their design process are:

-

Understand the environment

-

Create a process and leverage in-house expertise

-

Great execution is better than great strategy – sometimes it’s as simple as that

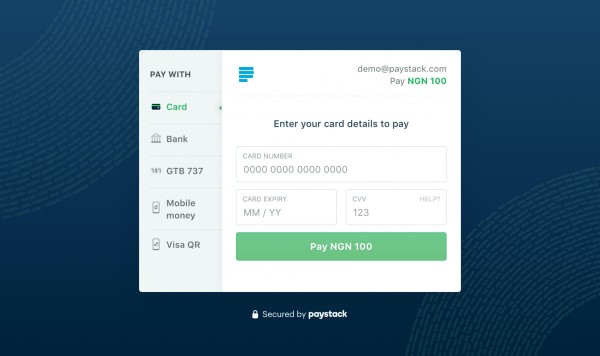

3. PayStack: Build trust by including your customers

PayStack wants to transform Africa’s diverse and often bureaucratic banking systems. Based in Nigeria, they let African businesses accept payments from anyone, anywhere in the world via credit card, debit card, money transfer and via their websites or apps.

PayStack recognised early on that they had to overcome their users’ lack of trust in payment systems. They listened to businesses and consumers to understand how to develop that trust. They discovered that they needed to offer a guarantee and simplify the payment process so that it didn’t pass through so many hands.

But that was just the first step. PayStack discovered that to maintain that trust, they needed to constantly consider their customers as they developed better products. They, like Plaid, involved users in their design process and communicated their product roadmap. PayStack quickly found that this transparency earned them the loyalty they needed to confidently start scaling their business.

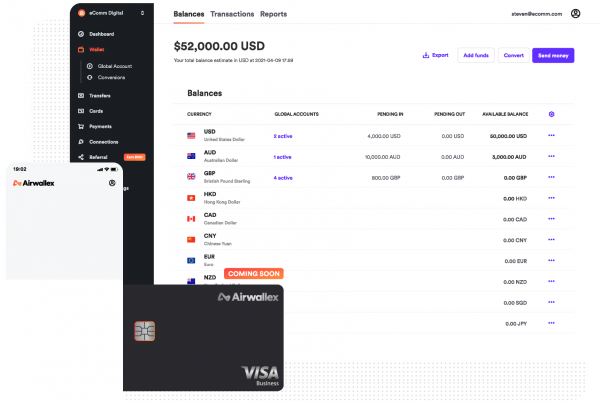

4. Airwallex: Gain empathy for your users

If Airwallex has one message on design as a strategic tool, it’s to gain empathy for your users. They talked us through a fantastic example of the contrast between the Airwallex sleek workspace and a very functional factory space they were designing for.

They asked how one person can design for another when their worlds are so different. For Airwallex, it’s an important question – their aim is to enable businesses to operate anywhere, anytime. And the answer, again, is through a customer-centric approach.

Airwallex’s process follows three clear steps:

-

Involve everyone from day one – make the most of everyone’s strengths, from analytical to emotional. The idea is to uncover the right questions to ask, discover customer pain points, and brainstorm solutions together.

-

Gain stakeholder alignment – to help manage everyone’s expectations. A client who’s an active member of the team is more invested in seeing the project succeed.

-

Understand the industry they’re designing for – the key word here is understand. Research is about more than the data it produces. It’s about immersing oneself and seeing the people on the other side of that data.

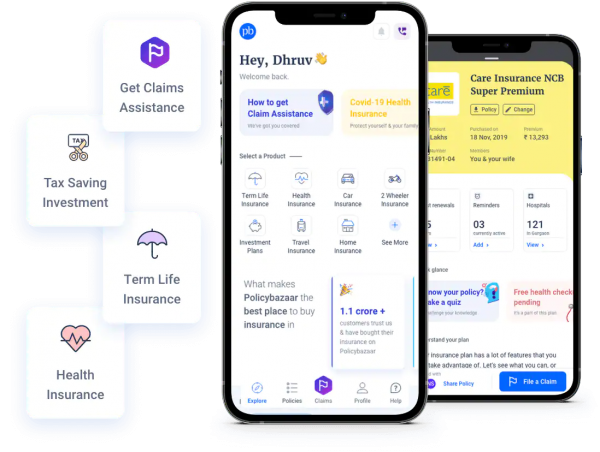

5. PolicyBazaar: Overcome customer concerns by building deeper understanding

PolicyBazaar is an Indian online insurance comparison portal. Much like PayStack, the basis of their success was in overcoming cultural perceptions and concerns.

PolicyBazaar knew it would take more than good marketing. In a country where insurance – including health insurance – is optional and there are socioeconomic factors at play, they needed to understand how people valued insurance in order to design a product that would be useful to them.

PolicyBazaar does this with data science and customer call analysis, which informs their product development, while they continue to involve their end-users in the process.

-

They segment and optimise their products by health problem.

-

End-user and behavioural research identifies what content customers engage with, to understand their decision-making process.

-

They define the right audience segment to target, then include that audience in their process.

6. CRED: Gamify your experience

The last talk we attended was by CRED. who have gamified credit card payments. Their members-only app rewards customers for paying their credit card bills on time, with access to additional services such as credit and premium products from high-end brands.

Should you start with a product or data? CRED suggest starting with an MVP, then optimising for UX based on the data you gather. Their design strategy includes:

-

Functionality and UX need to work hand in hand

-

Copy is integral to design

-

Validate your experiences with analytics and user research, then innovate

Design as strategy

Plaid, Revolut, PayStack, Airwallex, PolicyBazaar and CRED are among the most exciting and successful FinTech startups in the world right now. It was great to hear them talk about design strategy, process and empathy with their users – they’re subjects we’re passionate about, too.

Take, for example, Revolut, who focused on the challenge of varying financial regulations. Their core infrastructure enables them to adapt their platform swiftly to meet different local requirements and user expectations. Or see PolicyBazaar, who tease out their central challenges, then build super-targeted products rooted in user-centred design.

Process is therefore central to scaling. But process alone can only go so far. The other pillar to these companies’ common approach is, like Airwallex says, an empathic understanding of their customers and environment.

Holding these two pillars together is purpose. Purpose is a design team’s guiding light, the razor-sharp focus around which they develop the rest of the project’s structure. And even though words like “structure” and even “process” might not sound creative, we know from experience that they actually enhance a team’s creativity, allowing them to unlock original solutions.

Design applies to all facets of a business, from product to organisational function to brand identity. And in an age when technology is becoming more complex, design can simplify and humanise this complexity. It’s essential when creating products and services for users that meet business goals. For any innovative businesses out there, design should therefore be understood as a strategic function.

Or, in the words of Indra Nooyi, the former chairperson of PepsiCo: “Design leads to innovation, and innovation demands design.”

Get your free white paper today: Discover the 6 Pillars for Digital Transformation in Financial Services