In normal circumstances, we’d be looking forward to the Olympics in a few weeks’ time. As a runner, I follow the athletics closely, and as the father of two small children, I love watching the hurdling – it’s the nearest equivalent to the obstacle course I find myself navigating when walking across the lounge.

Of course, hurdles are a lot higher than a pair of toddlers (although they don’t have a habit of clinging to your legs whenever you get up from the sofa). I wondered, what if the hurdles could be lowered or raised? How low would a slower hurdler’s obstacles need to be for them to beat the faster racers?

That got me thinking about onboarding. When you’re trying to persuade a new customer to register or make their first purchase, you want the barriers in front of them to be as low as possible, especially compared to your competitors’. Anything you can do to lower or remove each hurdle will help more of them complete. Yet with regulation like 5mld around identity verification increasing, and customer data being ever more carefully guarded, it can feel like new obstacles are constantly being thrown in our way.

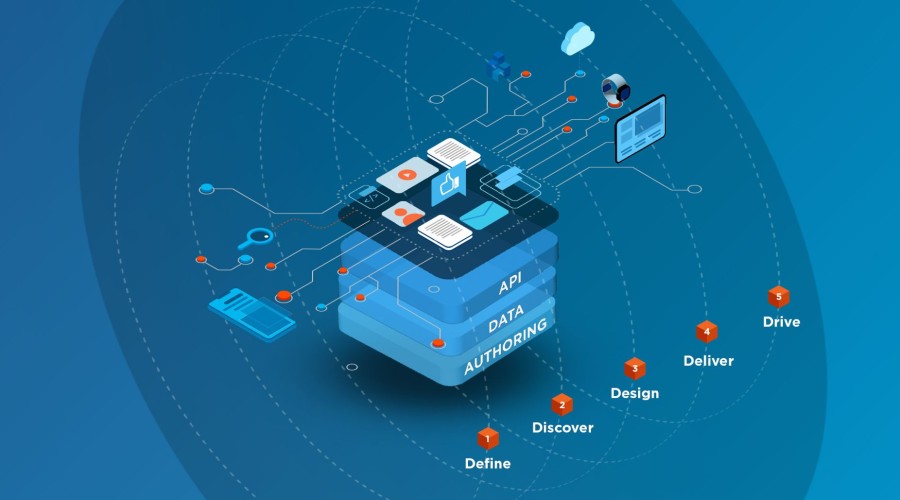

So how can we, as owners of the customer experience, give new customers the easiest, straightest path to onboarding? How can we perform Know Your Customer (KYC) checks without blocking their way? As you’ll see, there are two key things we can do: Observe, and then adapt.

And it starts with observing.

1. Test your customer onboarding journeys

Only usability testing can tell you if people really find your product easy and enjoyable to use. A strong user-centred design process will test every step of your customer journeys.

Watching and listening to your customers will give you rich insights to optimise your onboarding.

That’s especially critical when you’re getting people to register, verifying customer identities or sign up to a service for the first time. By watching users in action, you can see the bumps and snags in the verification process.

Combine your qualitative findings with quantitative data that shows where customers drop out of your journey. Then you can see the problem from an informed, holistic perspective.

2. Keep your customer verification interface simple

Users don’t want to spend all their time verifying their ID. They just want to use your service. A simple, intuitive design and efficient technology will help you deliver that. Once a user enters the onboarding journey, remove all distractions and visual clutter so you can keep them clearly focused on their task.

3. Incentivise your customers to complete onboarding

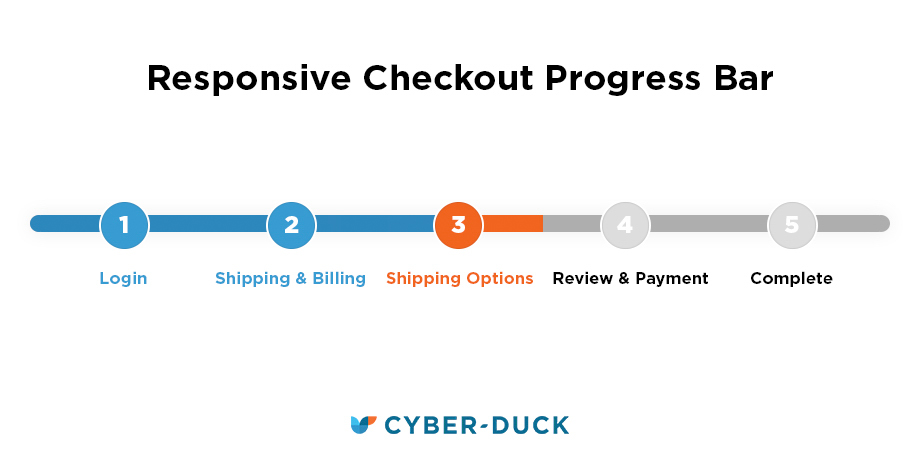

Then keep your onboarding and verification transparent. Show users where they are in their registration journey – it encourages them to complete the process. Validate their responses at each step, help them to complete identity checks and keep nudging them onwards.

If a user knows where they are in a journey, they are more likely to complete it.

4. Remove obstacles from your KYC journeys

Regulations put more demands on businesses, but the onus is also on you to make the experience as seamless as possible. Avoid complicated verification processes.

How can you do that?

- Don’t ask for more information than you need.

- Use clear, simple microcopy to complement your UX.

- Test your verification journey each time you make a change, to ensure it’s crystal clear to users.

- One great way to smooth their journey is to use innovative technologies such as verification with biometric data.

Talking of which…

5. Simplify identity checks with biometrics

Think about how you can incorporate new technologies to meet your regulatory obligations. Take Strong Customer Authentication (SCA), for example. Can you use facial recognition to speed up verification? Will Optical Character Recognition (OCR) help auto-fill data so users can quickly complete the registration process? Can you verify address by analysing location via GPS?

Biometric verification is more accessible than ever.

The cost of implementing biometric verification is falling. Consumers are getting increasingly comfortable with using their fingerprint or face to identify themselves. There’s never been a better time to see how biometrics could smooth your onboarding. Soon confirming your identity with a touch of your thumb or a wave at your phone’s camera will be an expectation, not just a nice-to-have. (Take that, passwords!)

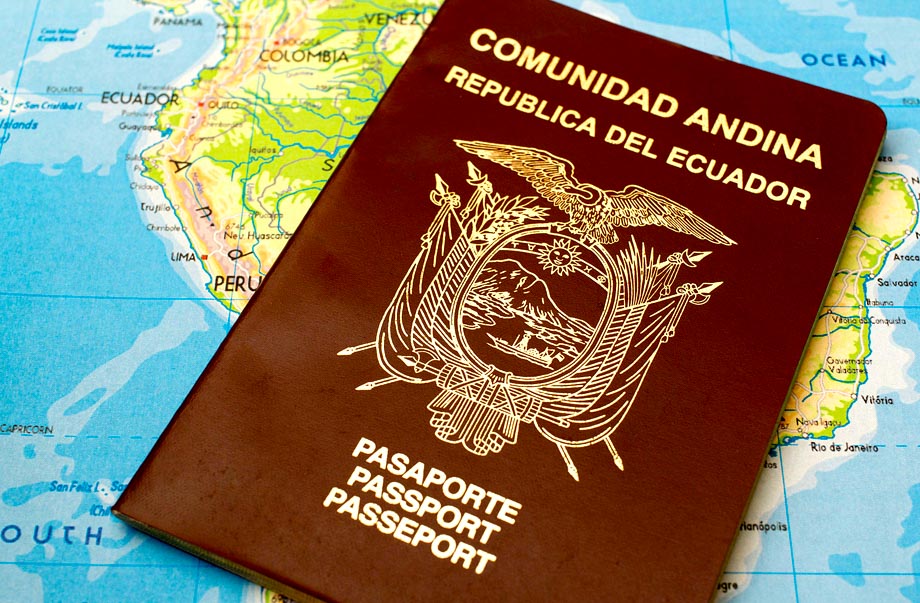

6. International variations for identity verification

If your customers could be overseas – or carry overseas identity – you’ll want to make sure all possible users can easily verify their identity on your platform. Have you considered differences in identity documents from country to country, or the different regulatory requirements for each country? If you’re using OCR to perform identity checks, can yours handle foreign documents?

Your customer verification may need to handle identity documents from around the world.

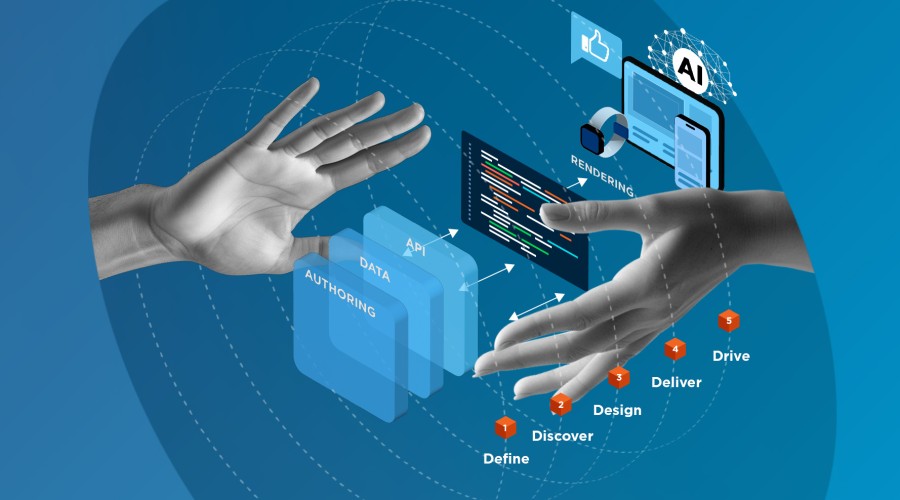

Easy, intuitive KYC checks and identity verification

Unlike hurdling, our customer journeys aren’t a level playing field. So it’s up to us to make them as clear and obstacle-free as we can. By combining the techniques above, you can see where customers are blocked or impeded and where you need to lower their barriers.

User-centred design will illuminate these journeys, so you can see where they’re working and where your customers need help. Biometric data can play a valuable role in smoothing their experience.

If we succeed in simplifying our onboarding, our customers will experience journeys with verification that’s seamless, easy and even – dare I say it – fun.

If we don’t, and especially if our competitors do, something that could be a simple journey will seem slow, awkward and filled with obstacles.

Just like when I try to get from the office to the kitchen to make a coffee with two small children attached to my legs. If only there was an Olympic category for that – I might be in with a chance …

If you’d like to find out more about customer identity verification, our free white paper has tips for building your strategy and lots of practical advice. Get it for free now.